The following list of “10 Awesome Blogs for Personal Finance in 2025” highlights some of the best sources for personal financial education.

In 2025, personal finance is evolving rapidly and staying informed has never been more crucial.

With new financial challenges and opportunities arising, blogs continue to serve as an essential resource for individuals looking to optimize their finances.

From navigating the complexities of investing to mastering budgeting techniques, top financial blogs offer the latest insights and advice to help readers take control of their financial futures.

These blogs cover a wide range of topics, including money management, investment strategies, and retirement planning, making them valuable to both beginners and seasoned financial enthusiasts.

Additionally, they delve into broader themes such as economic trends, sustainability in finance, and the role of technology in personal wealth management.

Whether readers are looking to eliminate debt, grow their investment portfolios, or plan for retirement, these blogs provide the knowledge and tools necessary to make informed, strategic decisions.

For anyone seeking to stay ahead in the ever changing world of personal finance, these top blogs of 2025 are a must follow.

10 Awesome Blogs For Personal Finance In 2025

The Penny Hoarder

The Penny Hoarder, founded in 2010, has grown into one of the largest personal finance brands in the U.S., reaching millions of readers each month.

It offers practical advice through articles and resources focused on helping people earn, save, and manage money more effectively.

Ranked for three consecutive years by the Inc 5000 as one of the fastest-growing private media companies, it has built a strong, loyal audience of around 12 to 15 million monthly readers.

In 2020, The Penny Hoarder was acquired by SYKES via its digital marketing subsidiary, Clearlink.

Despite this acquisition, its mission remains the same i.e. to reduce money stress by empowering individuals to make informed financial decisions.

It offers practical and actionable tips for everyday money management. It covers a wide range of topics, including frugal living, saving on everyday expenses, finding side hustles, and creative ways to make extra income.

As economic uncertainties, inflation, and job market changes affect millions, The Penny Hoarder helps readers find opportunities to improve their financial situation by making smarter decisions about spending and earning.

Whether you are looking for ways to budget more efficiently, cut back on discretionary spending, or discover the best side gigs to boost your income, The Penny Hoarder provides easy to follow guides, real-life success stories, and expert financial advice that makes managing money feel more attainable for everyone.

With 6.9 million Facebook fans and 1.2 million subscribers, it continues to be a trusted source for financial advice and solutions.

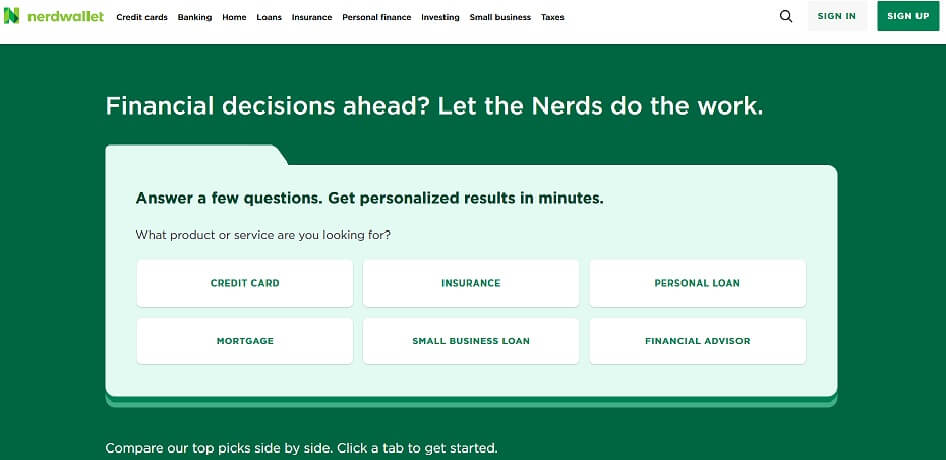

NerdWallet

NerdWallet is not your average financial services company. Their core belief is that everyone should have the confidence to make informed financial decisions.

With a dedicated team of passionate and skilled professionals, known as “Nerds,” they strive to provide clarity on all aspects of personal finance.

Their mission is to help people navigate life’s financial challenges with certainty.

At NerdWallet, values are at the heart of their operations.

These principles are more than just words on a wall; they are integrated into every decision and action the team takes.

Collaboration and understanding are key components of their culture, as the company believes that celebrating the success of others strengthens the entire organization.

The team is also committed to continuous improvement, embracing what they don’t know, and approaching feedback both giving and receiving with openness and courage.

NerdWallet encourages setting ambitious goals that challenge existing norms and treats setbacks as opportunities to learn and grow.

The company also holds a strong belief in corporate responsibility, aiming to do right by its employees, consumers, and communities.

This commitment to doing good is not just seen as ethical but as essential to their business success.

They emphasize the importance of diversity, equity, inclusion, and belonging (DEIB), making it a key part of their strategy.

By fostering an inclusive environment, they believe they can drive innovation, build resilience, and have a meaningful impact on the world.

NerdWallet’s corporate social responsibility (CSR) program focuses on improving financial access.

With a significant portion of Americans being unbanked or underbanked, NerdWallet supports community development credit unions that serve low and moderate income populations, helping to expand financial opportunities for those who need them most.

The main focus of NerdWallet is on Credit Cards, Loans, Investing, Insurance and Budgeting.

NerdWallet is one of the most comprehensive and reliable resources for personal finance, offering in-depth, easy-to-understand guidance on a wide range of financial topics.

It helps users navigate the increasingly complex landscape of credit cards, loans, and insurance by providing clear comparisons and expert advice on how to choose the best financial products for their needs.

With a focus on helping people make smarter financial decisions, NerdWallet offers detailed reviews, interest rate breakdowns, and a variety of calculators for things like mortgages, car loans, and credit card rewards.

For those interested in investing, it provides resources for beginner and advanced investors alike, with market insights, stock recommendations, and investment strategies.

As personal finance continues to evolve with new fintech innovations, NerdWallet remains a crucial tool for consumers looking to save money, optimize their spending, and make informed choices when it comes to credit, insurance, and investing.

The company also introduces educational resources like the “5 to Thrive” series, a self-guided program designed to empower individuals with the knowledge they need to achieve financial stability.

These five essential steps help people build a solid understanding of personal finance and prepare them for long-term success. To get started, individuals can access the series via Thinkific.

The Budget Mom

Kumiko Love, the founder of The Budget Mom (also known as TBM), is passionate about helping people transform their financial lives.

Her message is clear, “you don’t have to be perfect with money, nor do you need to make drastic sacrifices, like limiting your groceries to rice and beans, in order to get out of debt”.

The key is to find a budgeting system that works for your life, without having to give up things that matter to you.

Rather than suggesting a one-size-fits-all solution, TBM encourages people to create a personalized budgeting strategy that allows them to make wise financial decisions, both in the present and for the future.

If unexpected costs and overwhelming debt are making it seem impossible, Kumiko promises to show you exactly how to reshape your money story.

Kumiko’s journey to financial independence wasn’t an easy one. As a single mother earning $30,000 a year with $78,000 in debt, she often felt overwhelmed and helpless.

Every financial plan she tried seemed to assume she had a different lifestyle than hers, making it impossible to stick with any of them.

After countless unsuccessful attempts, Kumiko decided to develop her own system, a budget that fit her “real life” rather than a generic, one-size-fits-all solution.

This led to the creation of the “Budget by Paycheck” Method.

Once Kumiko had a system that worked, everything changed.

She paid off her debt, bought her dream home outright, and has since helped millions of women across the globe take control of their finances and improve their lives.

Growing up, Kumiko witnessed her mother, a single parent, struggle to make ends meet despite working hard every day.

Kumiko knew she didn’t want the same financial future for her own family but had no idea how to break the cycle.

She and her ex-husband never discussed money, and they lived paycheck to paycheck, just scraping by. When Kumiko’s son was born, she knew she needed to do things differently.

After her divorce, Kumiko found herself living in a cramped apartment, financially stressed, and longing for more stability.

Despite her limited income, she made decisions out of guilt and a desire to provide a better life for her son.

At one point, she used a credit card to buy $20,000 worth of furniture, putting her deeper into debt, with no plan to pay it off.

Kumiko started following various financial advice and creating budgets every week, but it felt like a constant cycle of restricting her spending, only to splurge on things she didn’t need.

She would often make impulse purchases, even charging a $1.09 ice cream cone for her son to a credit card, unsure if she could even afford it.

This was a wake-up call for Kumiko, who realized that something had to change.

She could no longer continue living like this, and neither her son nor she deserved to feel this way.

Determined to create a better financial future, Kumiko designed a budgeting system tailored to her real life needs, rather than trying to follow advice that didn’t align with her life.

This new system eventually became the “Budget by Paycheck” Method, which helped Kumiko get out of debt, buy her dream home in cash, and achieve the financial freedom she’d always dreamed of.

Kumiko didn’t initially plan for “The Budget Mom” to become a business.

When she first started her financial journey, she felt isolated, so she began posting budgeting videos online in search of a community that shared similar struggles.

Today, The Budget Mom has grown into a global community of women supporting each other in their journey toward financial independence.

Kumiko thinks that everyone deserves to feel in control of their money.

She believes that, If a single mother struggling with debt and guilt can turn her financial life around, anyone can.

She’s created eight simple steps to help others get started on their financial journey, and many of them are completely free.

Ryen Pilialoha joined The Budget Mom team in 2019 when the business was still run out of Kumiko’s tiny apartment.

Initially working as an assistant, Ryen now plays an integral role in the company’s daily operations, product development, and more.

She holds a degree in Human Resource Management and Economics from Eastern Washington University and currently resides in Kansas City with her fiancé, Cody, and their dog.

Frugalwoods

Liz is a financial consultant dedicated to helping people take control of their finances.

Her core philosophy is that managing money wisely creates the freedom to pursue unique dreams, providing endless possibilities for how one can live.

Liz is also the creator of Frugalwoods and the author of “Meet the Frugalwoods”.

Her journey is centered around embracing financial independence and crafting a life of intentionality.

Through her story, she shares the key decisions that led her to prioritize purpose over consumption and simplicity over excess.

Both Liz and her husband, Mr. Frugalwoods, attended the University of Kansas, where they met as freshmen.

They graduated in 2006 without any student loan debt, a result of attending an affordable state school, receiving scholarships, working while studying, and, most importantly, financial help from their families.

Though neither Liz nor Mr. Frugalwoods inherited any wealth, they feel incredibly fortunate to have received support for their education, enabling them to begin their adult lives debt-free.

After college, both Liz and Mr. Frugalwoods worked diligently to climb the career ladder, believing this was the path they would follow for the next 30 to 40 years.

In 2008, they married, and by 2011, Liz had completed her master’s degree without debt, working full-time at the university while studying. In 2012, they bought their first home, fully funded by their own savings.

That same year, they also adopted their beloved dog, Frugal Hound.

For a while, their lives seemed to be progressing according to the standard narrative.

However, things took an unexpected turn in 2012. Liz and Mr. Frugalwoods landed what they considered their “dream jobs”, management positions in offices with desks under artificial lights. They thought they had reached the peak of success.

But over time, they began to realize that, despite having achieved their career goals, they were deeply unfulfilled. They were living for the weekends, counting down the hours until 5 p.m. every day.

Neither of them felt any passion for their work, and they were spending much of their time earning money they weren’t even spending, all while feeling exhausted and stressed.

This was when they began to question the life they had built.

This realization prompted them to make a life changing decision i.e. to break free from the cycle of consumerism and materialism that seemed to dominate modern society.

In 2014, at the age of 30, Liz and Mr. Frugalwoods experienced what they called a shared quarter life crisis.

They realized they didn’t want to spend the next 40 years stuck in the same cubicles, working in jobs that didn’t fulfill them.

They began to dream about a different kind of life, one that didn’t rely on traditional office jobs.

They both agreed that they wanted to live simpler, closer to nature, and away from the hustle and bustle of city life.

Initially, they thought they would wait until retirement to make the move.

But as they talked more about it, they realized they didn’t want to wait another 35 years.

They wanted to start living their dream now. Thanks to their financial discipline, they were in a position to make this shift.

They had lived below their means for years, steadily increased their incomes, and saved aggressively.

By 2014, they had been saving for almost eight years, and the idea of achieving financial independence seemed not only possible, but imminent.

Liz and Mr. Frugalwoods decided to embrace extreme frugality and make their dream a reality.

With stable incomes and a commitment to saving, they realized they could make the shift to a simpler life much sooner than they had originally planned.

Through the Frugalwoods blog, Liz documents their experiences and shares the lessons they’ve learned along the way.

Her writing captures the highs, the lows, and the invaluable lessons from their pursuit of a simpler, more fulfilling life.

One of Liz’s primary goals in creating Frugalwoods is to build a community of people who value living intentionally rather than accumulating material goods.

Over time, Liz has been blessed to connect with a community of like minded individuals, and she’s grateful for the shared stories and experiences that have emerged from this online space.

Liz is excited for others to join them on this journey. For those ready to transform their relationship with money, she offers the “Uber Frugal Month Challenge” and encourages readers to explore the “Reader Case Studies” section to find inspiration and insights from others on a similar path.

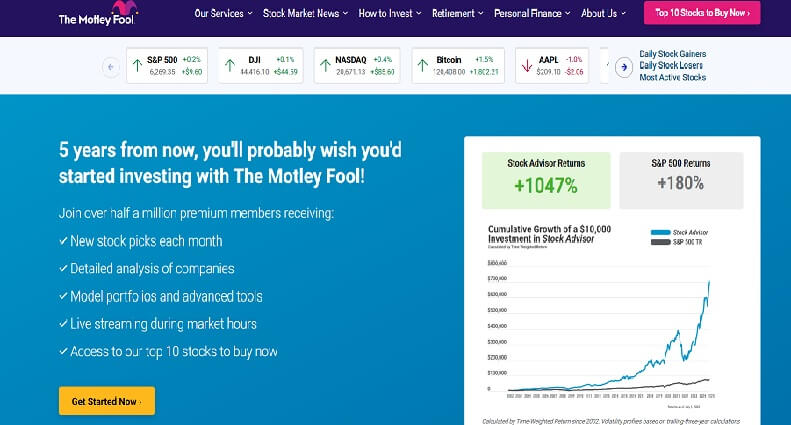

The Motley Fool

The Motley Fool is a financial services company established in 1993 with the mission to make the world smarter, happier, and richer.

It reaches millions of people each month through a combination of premium investment solutions, free market analysis, informative podcasts, and its charitable arm, The Motley Fool Foundation.

The name “The Motley Fool” is inspired by Shakespeare’s “As You Like It”, where the court jester, or “Fool,” had the rare ability to speak truths to the king and queen without fear of punishment.

Just as the Fool in the play used humor to challenge conventional wisdom, The Motley Fool aims to offer straightforward, honest financial guidance, helping individuals from all walks of life navigate the complexities of money and investing.

At its core, The Motley Fool exists to make the world smarter, happier, and richer by helping people achieve their financial goals.

The company believes that investing in strong, long-term businesses is the best way to build wealth and that every dollar should be viewed as an investment in the future.

This philosophy guides everything they do, ensuring they treat all individuals, employees, members, and the broader community with respect and care, following the principle of the “Golden Rule.”

The Motley Fool provides a range of financial tools and services, including both free and premium content.

Premium members receive in depth stock recommendations, detailed company analyses, model portfolios, and live video updates during market hours.

For those seeking free advice, the site offers frequent market news, articles, and commentary.

Additionally, there are exclusive tools and resources for members to manage their portfolios, track performance, and stay on top of the companies that interest them.

Financial Samurai

Founded by Sam Dogen in 2009, Financial Samurai has grown into one of the leading personal finance websites globally, attracting nearly a million visitors each month.

With a focus on providing practical financial advice based on firsthand experience, Sam emphasizes that personal finance is too important to be left to theoretical discussions.

Since its inception, Financial Samurai has seen over 100 million visitors, making it a trusted source for individuals looking to learn and grow their financial knowledge.

The site stands out due to its blend of expertise, relevance, and real-life storytelling.

Sam also announced the upcoming release of his new book, Millionaire Milestones: Simple Steps to Seven Figures.

With over three decades of financial experience and achieving millionaire status at just 28, Sam shares invaluable strategies to help readers build significant wealth.

Whether you’re aiming to reach seven figures or build financial freedom, this book is packed with practical steps for achieving your financial goals.

Sam believes the book will serve as a roadmap to help you not only become a millionaire but also take the steps necessary to enjoy financial independence and live life on your own terms.

It will be available for purchase on Amazon and various other platforms.

The site was born out of necessity during the turmoil of the 2008 global financial crisis. Sam, who had worked at prestigious financial institutions like Goldman Sachs and Credit Suisse, experienced firsthand the impact of the financial meltdown.

Despite aggressive saving, diversifying investments, and working in finance for over a decade, Sam found himself financially shaken.

This experience led him to create Financial Samurai in 2009, documenting his journey toward financial independence and early retirement.

Over time, his writings helped lay the foundation for the modern FIRE (Financial Independence, Retire Early) movement, which gained momentum in the years following.

Sam achieved financial independence in 2012, retiring at 34 after negotiating a severance package from his high-paying investment banking job.

In addition to his work on Financial Samurai, Sam is a bestselling author.

His 2022 book, Buy This, Not That, How to Spend Your Way to Wealth and Freedom, was a Wall Street Journal bestseller. The book offers readers tools for navigating major financial decisions in an uncertain world by focusing on probabilities rather than absolutes.

Sam’s other book, How to Engineer Your Layoff: Make a Small Fortune by Saying Goodbye (6th edition), focuses on helping people negotiate severance packages from jobs they no longer enjoy, giving them the financial flexibility to pursue their own passions.

This book became particularly significant for Sam, as it was his own severance package in 2012 that provided the financial cushion he needed to leave his corporate job and pursue a new lifestyle.

Financial Samurai covers a wide range of topics, from investing and real estate to retirement planning and career strategies.

Sam’s mission is to help readers achieve financial independence earlier rather than later, giving them the freedom to live life on their own terms.

Having retired at 34, Sam has had the opportunity to live a life of freedom and encourages others to do the same.

His writing, based on personal experience, aims to highlight common financial pitfalls and help readers avoid costly mistakes.

The site has garnered attention from major publications like Forbes, The New York Times, The Wall Street Journal, and Yahoo Finance, among others. Sam has also shared his expertise through interviews with AARP, Newstalk Radio 910AM, and Bloomberg.

Financial Samurai remains committed to helping people achieve financial security and independence so they can focus on what truly matters.

How to Money

Joel and Matt are close friends who share a deep passion for discussing personal finance, often over a beer.

This love for money talk led them to create a podcast, which has since garnered over 45 million downloads.

Their mission is clear: to provide practical, accessible financial advice to everyday people.

As per them a troubling 40% of Americans are unprepared for a surprise $400 expense, many college graduates are burdened with staggering amounts of debt, and the personal finance landscape has become more complicated than ever before.

And changing the way individuals approach their finances is a critical part of the solution. However, the journey is filled with uncertainty they say.

How To Money is a podcast and website designed to offer practical knowledge and tools to help people navigate debt repayment, start DIY investing, and learn essential financial tips for long-term success.

The founders emphasize that access to free, unbiased, and jargon-free financial guidance is more necessary today than ever before.

Joel’s passion for personal finance stems from his own financial struggles growing up.

Witnessing his family’s money challenges motivated him to embark on a journey to figure out how to manage money without constant stress.

What he discovered was that financial peace is possible, and he’s now dedicated to helping others achieve that same sense of relief.

The creation of How To Money is Joel’s way of turning his own financial obsession into a resource that empowers others with the knowledge and tools to confidently handle their finances.

His goal isn’t to encourage people to pursue billionaire status but to help them build a healthy and stress-free relationship with money.

Matt’s interest in personal finance became more intense during a conversation with his wife, Kate, while they were on a drive to a photography shoot.

As they discussed the challenges of running their own small business, they found themselves talking about financial independence after watching Downton Abbey.

Kate’s question about how the fictional Crawley family could live without traditional jobs sparked a deeper discussion about the freedom that comes with financial independence.

Although Matt and Kate had no desire to live a life of luxury or opulence, they realized they wanted more options in life.

They dreamed of having the freedom to decline a photography job that wasn’t the right fit, travel spontaneously, or take time off to raise a family.

For Matt and Joel, the goal isn’t about amassing wealth but gaining the freedom to live life on their terms

Joel and Matt’s mission is to help others take control of their finances so they can live more fulfilling and flexible lives, with the belief that financial mastery is the key to achieving true freedom.

Their focus is not on wealth for wealth’s sake, but on gaining the independence to make life choices without being constrained by money.

Ruth Soukup

Ruth Soukup is on a mission to help women everywhere create lives they love.

Whether that means starting an online business, losing weight and getting healthy, or simply finding more purpose and joy, Ruth has a wealth of experience to guide you through the process.

Ruth started her business in 2010 with a personal blog called “Living Well Spending Less”.

At the time, she was a stay at home mom of two toddlers, searching for a way to gain control over her home and budget.

Writing about her own journey, including her battle with depression, gave her the accountability she needed to create meaningful change in her life.

Little did she know, this personal story would resonate with thousands of other women going through similar challenges. As a result, her blog grew rapidly, eventually reaching over a million women weekly.

Ruth’s passion for helping others led her to write books, create courses, and develop products to assist women in managing their time and organizing their homes.

As Ruth’s business grew, she started receiving more and more questions from women interested in starting their own blogs or online businesses.

In 2014, she founded Ruth Soukup Business, and over the past decade, she has helped more than 15,000 women build successful online businesses, some even generating 6, 7, and 8-figure incomes.

Through her program, “Powerhouse”, Ruth teaches a comprehensive, proven process for creating and growing a predictable and profitable online business.

Ruth soon realized that a common barrier for women pursuing their dreams was fear.

Curious to understand this better, she spent more than two years surveying over 4,000 women about the role of fear in their lives.

This research ultimately led her to develop the Fear Archetype Assessment and write the book Do It Scared. Ruth has also given a TED talk on this topic, which has garnered more than 300,000 views.

In 2021, after years of struggling with her weight, Ruth decided to stop dieting and started researching the science behind weight loss.

She was shocked to discover that much of what we’ve been told about health and weight loss is misleading.

Rather than focusing on counting calories or pushing the “eat less, exercise more” mantra, Ruth found that the key to weight loss lies in understanding hormones.

This new approach led her to lose over 40 pounds, which she has successfully kept off.

Ruth’s own transformation inspired her to create “Thinlicious”, a program that has already helped thousands of women lose weight and get healthy without relying on restrictive diets, drugs, or misery.

The Frugal Girl

Kristen, better known online as The Frugal Girl, is the voice behind this blog.

A friendly introvert and proud ISFJ, she’s someone who thrives in the comfort of her own space, loves taking photos, and is always working on a DIY project.

As a mindful spender and someone who avoids waste, Kristen has found a way to live frugally while staying cheerful, all while being a mom to four adult children.

Based on the east coast of the United States, Kristen is currently pursuing her R.N. degree, set to graduate in the spring of 2025.

In the meantime, she works as a student nurse patient care tech, a job she truly loves and feels she was meant to do.

In early 2022, Kristen made the tough decision to leave her marriage of 25 years, and by 2024, her divorce was finalized.

Although it was a life change she never imagined, Kristen describes it as one of the best decisions she’s ever made, with zero regrets.

During this transition, she found a new home to live in and furnished it on a tight budget. She also transformed an old, rundown bookshelf into something beautiful, one of many ways she brings new life to old things.

Kristen has been passionate about saving money since she was a child, and through her blog, she aims to inspire others to live more frugally while maintaining a positive attitude.

Her focus is on sustainable living, reducing food waste, mindful spending, and investing in high-quality items that stand the test of time.

While Kristen isn’t into extreme couponing, sample sign ups, or hunting for the latest deals, she offers something different: practical, everyday advice for living frugally with a bit of creativity and style.

Her blog offers a mix of content, from delicious recipes and DIY projects to frugal home décor ideas, upcycling tips, and advice on living simply and finding contentment.

Kristen’s goal is to show that living on less doesn’t mean sacrificing joy, it’s about making intentional choices and getting creative with what you already have.

Smart Passive Income

Pat Flynn’s background as an architect turned entrepreneur resonates with many people. In 2008, after being laid off from his job as an architect, Pat took to online business and quickly found success.

His first major project was an online study guide for a professional exam, which earned him passive income and gave him the confidence to try other business ventures.

Over time, he became well known for his transparency, especially with sharing his income reports and teaching others to replicate his success.

Smart Passive Income (SPI), founded by Pat Flynn in 2008, is a platform dedicated to helping entrepreneurs and aspiring business owners build online businesses that generate passive income.

It serves as a resource hub with various tools, insights, and strategies aimed at helping individuals create scalable and sustainable income streams.

The primary mission of SPI is to empower people to create businesses that provide financial independence and the freedom to work on their own terms.

Pat Flynn, who gained early success with his online ventures, shares his personal experiences and lessons learned along the way, including both successes and failures.

His transparency and willingness to share his income reports (a practice he started early on) have built trust and credibility within the community.

Smart Passive Income (SPI) is organized around several key categories to help users build and grow their online businesses.

The Smart Passive Income Podcast, hosted by Pat Flynn, is a standout feature, offering practical advice, interviews with successful entrepreneurs, and personal success stories.

The SPI blog serves as an extensive resource library, covering topics like online business models (affiliate marketing, online courses, blogging), social media strategies, product creation, SEO, content marketing, and productivity tips for entrepreneurs.

SPI also offers various courses like Power-Up Podcasting, Smart From Scratch, Flipped Lifestyle, and SPI Pro, which provide in-depth guidance on creating and scaling online businesses.

Additionally, SPI provides free resources, including downloadable guides, eBooks, templates, and business tool recommendations.

One of the site’s most unique features is Pat Flynn’s income reports, which he has published regularly since its inception, offering full transparency about his earnings, strategies, and how others can replicate his success.

True to its name, Smart Passive Income focuses on the concept of passive income, money earned with minimal ongoing effort.

Pat Flynn often emphasizes that while establishing a passive income stream requires significant upfront work, it can offer long-term returns with less daily involvement, in contrast to traditional active-income models like a 9-to-5 job.

The core idea is to build automated systems and processes that generate revenue with minimal ongoing effort.

This can be achieved through methods such as affiliate marketing (earning commissions by recommending products or services), creating and selling digital products (like online courses, eBooks, and templates), monetizing blogs or podcasts, and developing membership sites.

The Smart Passive Income community is another major part of the platform’s value proposition.

Entrepreneurs can join forums, attend live events, and engage with others in the same boat.

The SPI community provides a sense of connection, accountability, and support, which is especially important for entrepreneurs working on their own.

Pat Flynn also hosts live events, such as SPI Live and Podfest Expo, which offer opportunities for networking and learning from industry experts.

In addition to educational resources, SPI offers numerous affiliate product recommendations for tools and services that can help entrepreneurs in their business journey.

These include web hosting services, email marketing platforms, course creation tools, and more.

Pat’s transparent approach to affiliate marketing allows him to recommend tools that he genuinely uses and believes in, which adds to the authenticity of the site.

Smart Passive Income has become a trusted name in the online business world.

Its practical approach to passive income, coupled with a genuine focus on helping others, has made it a valuable resource for many entrepreneurs.

Over the years, Pat Flynn has turned SPI into not just a website, but a thriving community and learning hub for those seeking financial independence through online businesses.

Conclusion

Staying informed and proactive about personal finance is crucial to achieving financial stability and success.

The blogs mentioned here offer valuable insights, actionable tips, and expert advice to help you navigate the complexities of money management.

Whether you’re looking to save more, invest wisely, or simply understand the basics of personal finance, these resources can serve as your go to guides on the journey toward financial independence.

So, make sure to explore these blogs regularly and continue building a solid foundation for your financial future.

Passionate about empowering others to make smart financial choices while embracing a balanced, fulfilling lifestyle. Join me as we navigate the world of finance and living a purposeful life.